Monthly Investment Opportunities in Stark County, Ohio

Imagine acquiring property in Stark County, Ohio, where monthly Delinquent Tax and Tax Lien Sales offer a unique investment edge. In this county, with Canton as its county seat, you have the opportunity to purchase properties at appealing prices during these sales held on the first Tuesday of each month at 9:00 AM in downtown Canton.

Here’s how it works:

You must provide a deposit of 10% of your winning bid, with a minimum of $500, on the day of the sale. All sales are final and “as is,” with properties not typically open for inspection before the sale.

The bidding process is exclusively in-person. Bids increase in minimum increments of $100. Payment methods have evolved, with the county now requiring two checks for the winning bid – one for the deposit and another for the deed recording fee.

The Treasurer’s attorney sets the minimum bid for tax foreclosures in Stark County, and the county advertises the properties in the Canton Repository for three weeks before the sale.

Important Details in Investing in Stark County, OH

Here’s a quick overview of the essential details for the County’s tax lien and tax deed sales:

| Detail | Information |

|---|---|

| Tax Sale Type | Tax Deed Sale |

| Typical Date of Sale | First Tuesday of each month at 9:00 AM |

| Bid Procedure | Premium bid |

| Deposit Requirement | 10% of winning bid, but not less than $500 |

| Payment Methods | Certified or cashier’s checks only. Two checks required |

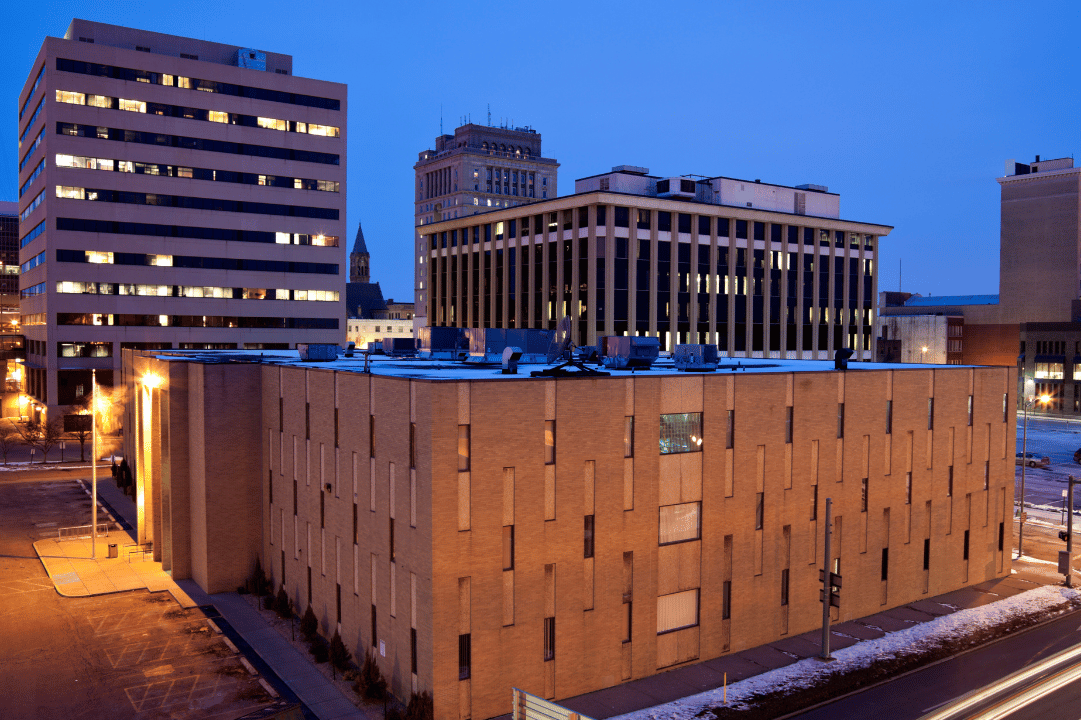

| Location | Stark County Office Building, 110 Central Plaza, South, 1st Floor Event Hall, Canton, OH 44702 |

| Contact | Stark County Sheriff’s Office – Delinquent Tax and Tax Lien Sales |

| Website for Information | Stark County Sheriff’s Sales |

Key Links

- County Tax Lien Information

- County Sheriff’s Office

- County Official Website

- Auction Site Address: Stark County Office Building, 110 Central Plaza, South, 1st Floor Event Hall, Canton, Ohio 44702

Interesting Facts About Stark County

Stark County is located in the U.S. state of Ohio, and as of the 2020 census, it has a population of 374,853. The county seat is Canton, known for its rich history and significance in the American Revolutionary War, named after John Stark.

Pro Tips for Investors

- Do Your Homework: Research the properties and their conditions thoroughly before attending the auction. Although you cannot inspect the properties, you can look into their history and any available public records.

- Understand the Payment Requirements: Be prepared with the required payment methods. Ensure you have the correct types of checks and amounts ready on the day of the auction.

- Be Aware of Legal Procedures: Familiarize yourself with the legal framework and processes involved in tax lien and tax deed investing in Stark County.

FAQs

Q: What happens if I win a bid at the auction?

A: You’ll need to pay a deposit of 10% of your winning bid (minimum $500) by noon on the day of the sale. The remaining balance is due within 30 days from the confirmation of the sale date.

Q: Can I inspect the property before buying?

A: No, properties are sold “as is” and are not open for inspection prior to the sale.

Q: How are properties advertised before the sale?

A: The county advertises properties in the Canton Repository for three consecutive weeks before the sale date.

For more details, visit the Stark County Treasurer’s Office and Stark County Sheriff’s Sales websites.

Need a Hand?

If you’re looking for assistance and guidance with tax lien investing, consider reaching out to local experts or joining a community of investors to share insights and strategies. Feel free to book a call for personalized help. Happy investing!

Sign up to view the full content.

Join Us

Learn how to get 18-36% returns on your investment and buy property for as little as $500 with tax lien and tax deeds.